Zsolt Bihary – Péter Csóka – Dávid Zoltán Szabó: Spectral risk measure of holding stocks in the long run

Abstract

We investigate how the spectral risk measure associated with holding stocks rather than a

risk-free deposit, depends on the holding period. Previous papers have shown that within a

limited class of spectral risk measures, and when the stock price follows specific processes,

spectral risk becomes negative at long periods. We generalize this result for arbitrary

exponential Lévy processes. We also prove the same behavior for all spectral risk measures

(including the important special case of Expected Shortfall) when the stock price grows

realistically fast and when it follows a Geometric Brownian Motion or a Finite Moment Log

Stable process. This result would suggest that holding stocks for long periods has a vanishing

risk. However, using realistic models, we find numerically that the risk increases for a few

decades and reaches zero at around 100 years. Therefore, we conclude that holding stocks

is risky for all practically relevant periods.

Nem található esemény a közeljövőben.

A KRTK Közgazdaság-tudományi Intézet teljesítményéről A KRTK KTI a RePEc/IDEAS rangsorában, amely a világ közgazdaság-tudományi tanszékeit és intézeteit rangsorolja publikációs teljesítményük alapján, a legjobb ... Read More »

Tisztelt Kollégák! Tudományos kutatóként, intézeti vezetőként egész életünkben a kutatói szabadság és felelősség elve vezetett bennünket. Meggyőződésünk, hogy a tudomány csak akkor érhet el ... Read More »

Srí Lanka: a 2022-es gazdasági válság leckéje – A. Krueger Lessons from Sri Lanka Anne O. Krueger Jul 25, 2022 – Project Syndicate ... Read More »

A permanens válság korában élünk – J. Meadway We’re living in an age of permanent crisis – let’s stop planning for a ‘return ... Read More »

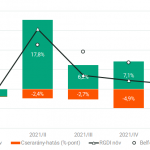

A 2021 végén, illetve 2022 elején tapaszalt 6, illetve 7%-os cserearányromlás brutális reáljövedelem-kivonást jelentett a magyar gazdaságból. A külső egyensúly alakulásával foglalkozó elemzések többnyire ... Read More »