by Mordecai Kurz, Stanford University

This draft June 25, 2017

Abstract

We show modern information technology (in short IT) is the cause of rising income and wealth inequality since the 1970’s and has contributed to slow growth of wages and decline in the natural rate.

We first study all US firms whose securities trade on public exchanges. Surplus wealth of a firm is the difference between wealth created (equity and debt) and its capital. We show (i) aggregate surplus wealth rose from -$0.59 Trillion in 1974 to $24 Trillion which is 79% of total market value in 2015 and reflects rising monopoly power. The added wealth was created mostly in sectors transformed by IT. Declining or slow growing firms with broadly distributed ownership have been replaced by

IT based firms with highly concentrated ownership. Rising fraction of capital has been financed by debt, reaching 78% in 2015.

JEL classification: D31, D33, D42, D43, D62, E22, E25, L1.

Keywords: surplus wealth; Information Technology; monopoly pricing power; income inequality; wealth

inequality; relative shares; monopoly surplus; monopolistic competition; technical change and TFP.

Nem található esemény a közeljövőben.

A KRTK Közgazdaság-tudományi Intézet teljesítményéről A KRTK KTI a RePEc/IDEAS rangsorában, amely a világ közgazdaság-tudományi tanszékeit és intézeteit rangsorolja publikációs teljesítményük alapján, a legjobb ... Read More »

Tisztelt Kollégák! Tudományos kutatóként, intézeti vezetőként egész életünkben a kutatói szabadság és felelősség elve vezetett bennünket. Meggyőződésünk, hogy a tudomány csak akkor érhet el ... Read More »

Srí Lanka: a 2022-es gazdasági válság leckéje – A. Krueger Lessons from Sri Lanka Anne O. Krueger Jul 25, 2022 – Project Syndicate ... Read More »

A permanens válság korában élünk – J. Meadway We’re living in an age of permanent crisis – let’s stop planning for a ‘return ... Read More »

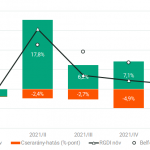

A 2021 végén, illetve 2022 elején tapaszalt 6, illetve 7%-os cserearányromlás brutális reáljövedelem-kivonást jelentett a magyar gazdaságból. A külső egyensúly alakulásával foglalkozó elemzések többnyire ... Read More »