International Business Cycle and Financial Intermediation

Tamás Csabafi – Max Gillman – Ruthira Naraidoo

Abstract

The paper extends a standard two-country international real business cycle model to include

financial intermediation by banks of loans and government bonds. Taking in household

deposits from home and abroad, the loans are produced by the bank in a Cobb-Douglas

production approach such that a bank productivity shock can explain financial data

moments. The paper contributes an explanation, for both the US relative to the Euro-area,

and the US relative to China, of cross-country correlations of loan rates, deposit rates, and

the loan premia. It provides a sense in which financial retrenchment resulted in the US

following the 2008 bank crisis, and how the Euro-area and China reacted. The paper

contributes evidence of how the Euro-area has been more financially integrated with the US,

and China less financially integrated, with the Euro-area becoming more financially

integrated after the 2008 crisis, and China becoming less so integrated.

A teljes tanulmány letölthető innen.

Nem található esemény a közeljövőben.

A KRTK Közgazdaság-tudományi Intézet teljesítményéről A KRTK KTI a RePEc/IDEAS rangsorában, amely a világ közgazdaság-tudományi tanszékeit és intézeteit rangsorolja publikációs teljesítményük alapján, a legjobb ... Read More »

Tisztelt Kollégák! Tudományos kutatóként, intézeti vezetőként egész életünkben a kutatói szabadság és felelősség elve vezetett bennünket. Meggyőződésünk, hogy a tudomány csak akkor érhet el ... Read More »

Srí Lanka: a 2022-es gazdasági válság leckéje – A. Krueger Lessons from Sri Lanka Anne O. Krueger Jul 25, 2022 – Project Syndicate ... Read More »

A permanens válság korában élünk – J. Meadway We’re living in an age of permanent crisis – let’s stop planning for a ‘return ... Read More »

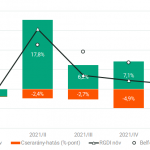

A 2021 végén, illetve 2022 elején tapaszalt 6, illetve 7%-os cserearányromlás brutális reáljövedelem-kivonást jelentett a magyar gazdaságból. A külső egyensúly alakulásával foglalkozó elemzések többnyire ... Read More »