Abstract: This paper uses the historical narrative record to determine whether inflation expectations shifted during the second quarter of 1933, precisely as the recovery from the Great Depression took hold. First, by examining the historical news record and the forecasts of contemporary business analysts, we show that inflation expectations increased dramatically. Second, using an event-studies approach, we identify the impact on financial markets of the key events that shifted inflation expectations. Third, we gather new evidence–both quantitative and narrative–that indicates that the shift in inflation expectations played a causal role in stimulating the recovery.

Keywords: Great Depression, inflation expectations, liquidity trap, narrative evidence, regime change

May 2015

Nem található esemény a közeljövőben.

A KRTK Közgazdaság-tudományi Intézet teljesítményéről A KRTK KTI a RePEc/IDEAS rangsorában, amely a világ közgazdaság-tudományi tanszékeit és intézeteit rangsorolja publikációs teljesítményük alapján, a legjobb ... Read More »

Tisztelt Kollégák! Tudományos kutatóként, intézeti vezetőként egész életünkben a kutatói szabadság és felelősség elve vezetett bennünket. Meggyőződésünk, hogy a tudomány csak akkor érhet el ... Read More »

Srí Lanka: a 2022-es gazdasági válság leckéje – A. Krueger Lessons from Sri Lanka Anne O. Krueger Jul 25, 2022 – Project Syndicate ... Read More »

A permanens válság korában élünk – J. Meadway We’re living in an age of permanent crisis – let’s stop planning for a ‘return ... Read More »

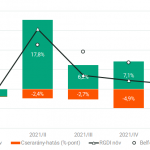

A 2021 végén, illetve 2022 elején tapaszalt 6, illetve 7%-os cserearányromlás brutális reáljövedelem-kivonást jelentett a magyar gazdaságból. A külső egyensúly alakulásával foglalkozó elemzések többnyire ... Read More »