NBER Working Paper No. 21693

Issued in October 2015

NBER Program(s): AP

History is important to the study of financial bubbles precisely because they are extremely rare events, but history can be misleading. The rarity of bubbles in the historical record makes the sample size for inference small. Restricting attention to crashes that followed a large increase in market level makes negative historical outcomes salient. In this paper I examine the frequency of large, sudden increases in market value in a broad panel data of world equity markets extending from the beginning of the 20th century. Markets that doubled in real terms in a single year had a 6.9% probability of halving in value the following year and a 17.2% chance of halving in value over the subsequent five years. In simple terms, bubbles are booms that went bad. Not all booms are bad. This paper is available as PDF (743 K).

A non-technical summary of this paper is available in the January 2016 NBER digest.

You can sign up to receive the NBER Digest by email.

Nem található esemény a közeljövőben.

A KRTK Közgazdaság-tudományi Intézet teljesítményéről A KRTK KTI a RePEc/IDEAS rangsorában, amely a világ közgazdaság-tudományi tanszékeit és intézeteit rangsorolja publikációs teljesítményük alapján, a legjobb ... Read More »

Tisztelt Kollégák! Tudományos kutatóként, intézeti vezetőként egész életünkben a kutatói szabadság és felelősség elve vezetett bennünket. Meggyőződésünk, hogy a tudomány csak akkor érhet el ... Read More »

Srí Lanka: a 2022-es gazdasági válság leckéje – A. Krueger Lessons from Sri Lanka Anne O. Krueger Jul 25, 2022 – Project Syndicate ... Read More »

A permanens válság korában élünk – J. Meadway We’re living in an age of permanent crisis – let’s stop planning for a ‘return ... Read More »

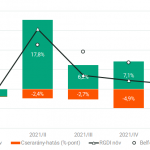

A 2021 végén, illetve 2022 elején tapaszalt 6, illetve 7%-os cserearányromlás brutális reáljövedelem-kivonást jelentett a magyar gazdaságból. A külső egyensúly alakulásával foglalkozó elemzések többnyire ... Read More »